Insights Hub

Your go-to source for the latest news and information.

Marketplace Liquidity Models: A Deep Dive into the Balancing Act

Unlock the secrets of marketplace liquidity models! Discover the art of balancing supply and demand in our deep dive exploration.

Understanding Marketplace Liquidity: Key Models Explained

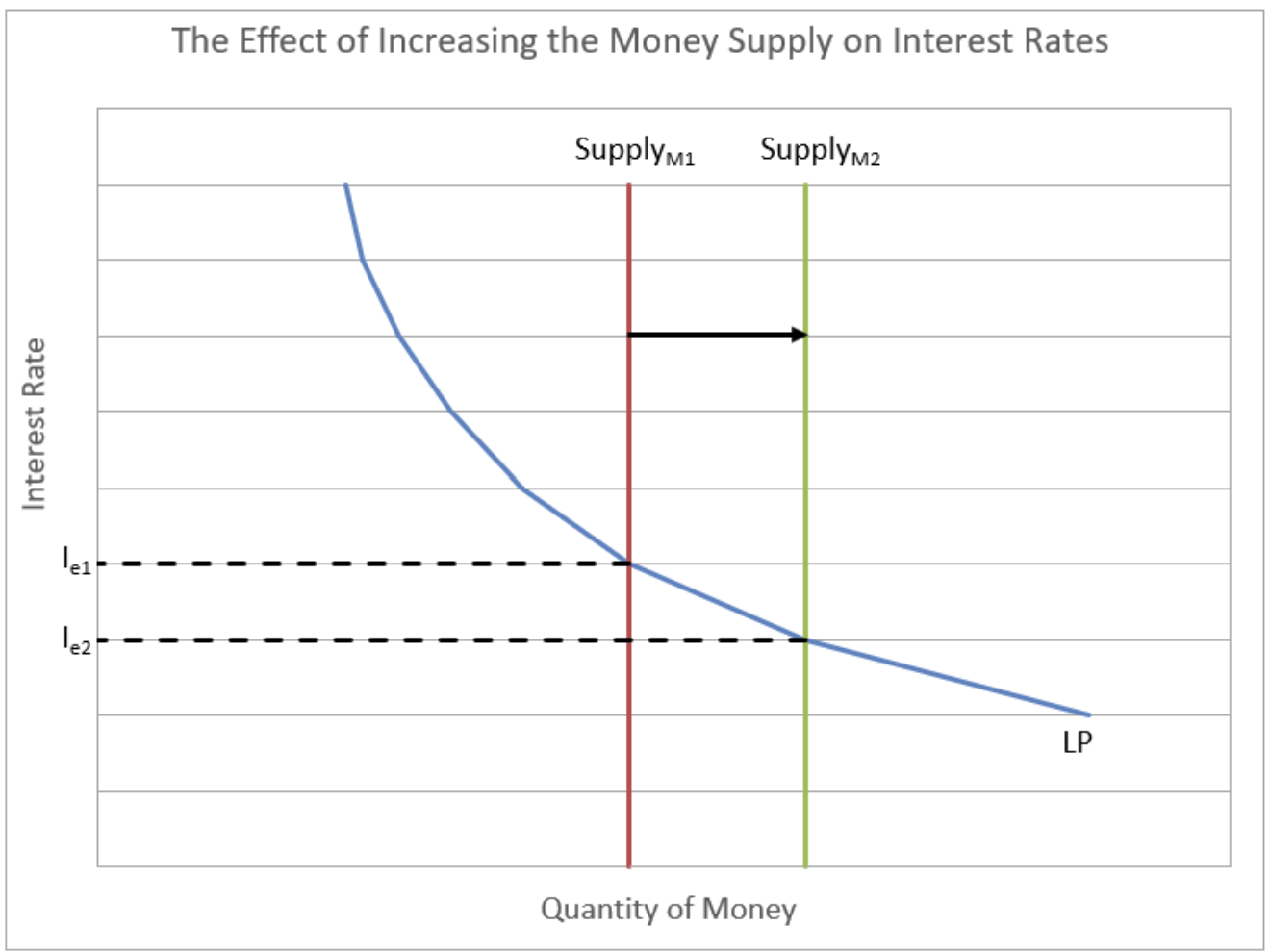

Marketplace liquidity refers to how quickly and easily assets can be bought or sold in a market without causing a significant impact on their price. Understanding the fundamental liquidity models is crucial for investors and traders alike, as it helps them assess the viability of their trading strategies. The two primary models of liquidity are order-driven markets and quote-driven markets. In an order-driven market, the prices are determined through the aggregation of buy and sell orders, where market participants leverage their orders to establish market prices. Conversely, in a quote-driven market, liquidity providers, such as market makers, offer to buy and sell assets at specified prices, creating a more stable trading environment.

Another critical aspect of marketplace liquidity is the depth of the market, which refers to the market's ability to sustain large orders without significant price changes. A deep market typically indicates high liquidity, enabling large transactions to occur with minimal slippage. To further understand how liquidity operates, one might also consider the concept of the liquidity premium, which indicates the extra return investors demand for holding less liquid assets. By grasping these key liquidity models, traders can make better-informed decisions, optimize their trades, and minimize risks associated with poor liquidity.

Counter-Strike is a popular first-person shooter game that has captivated gamers since its inception in the late 1990s. The game places players in two opposing teams, terrorists and counter-terrorists, where they compete to complete objectives or eliminate the other team. Players often seek ways to enhance their gameplay experience, and for those looking to unlock new skins and items, using a daddyskins promo code can be an effective strategy.

The Essentials of Balancing Act in Marketplace Liquidity

In today’s dynamic marketplace, maintaining a strong sense of liquidity is crucial for both buyers and sellers. Liquidity refers to the ease with which assets can be converted into cash without significantly affecting their price. To achieve an optimal balance, it is essential to understand the demand and supply factors that influence market conditions. Businesses must strategically manage their inventory levels and pricing strategies to ensure that they can respond effectively to changes in demand while minimizing the risks of overstocking or stockouts.

Furthermore, the role of technology in enhancing market liquidity cannot be overstated. Platforms that provide real-time data and analytics empower stakeholders with the information needed to make informed decisions. By leveraging advanced algorithms and trading systems, market participants can enhance their liquidity by matching buyers and sellers more efficiently. As such, embracing innovations in technology and adopting a clear strategy focused on liquidity are the essentials of balancing act in a competitive marketplace.

How Do Different Liquidity Models Impact Marketplace Performance?

The impact of different liquidity models on marketplace performance is crucial for understanding how efficiently a marketplace operates. Liquidity refers to the ease with which assets can be bought or sold without causing drastic price changes. In a marketplace, high liquidity often means more buyers and sellers are active, which can lead to tighter spreads and more competitive pricing. For instance, centralized liquidity models typically provide higher liquidity, allowing traders to execute large orders without significantly affecting market prices, thereby enhancing overall marketplace performance.

Conversely, decentralized liquidity models may present challenges in achieving the same level of performance due to fragmentation. However, they can also foster greater transparency and security, appealing to users who prioritize these aspects. As liquidity models evolve, understanding their unique impacts on marketplace performance becomes essential for both users and platform developers. In essence, the efficiency of a marketplace can be significantly altered by the type of liquidity model it adopts, influencing buyer and seller behavior and ultimately determining the platform's success.