Insights Hub

Your go-to source for the latest news and information.

CS2 Reverse Trading: The Sneaky Path to Profit Wonderland

Unlock the secrets of CS2 reverse trading and discover how to turn sneaky strategies into a profit paradise. Dive in now!

Understanding CS2 Reverse Trading: Strategies for Success

Understanding CS2 Reverse Trading is essential for traders looking to enhance their strategies in the ever-evolving digital market. This approach involves analyzing market patterns and making informed decisions based on reverse signals. By recognizing when to buy or sell contrary to current trends, traders can potentially maximize their profits. To implement CS2 Reverse Trading effectively, you must first master key indicators and tools that help predict market shifts. Familiarity with concepts such as support and resistance levels, alongside price action analysis, can significantly improve your trading outcomes.

Successful CS2 Reverse Trading requires a disciplined mindset and a robust strategy. Here are three crucial strategies to consider:

- Market Sentiment Analysis: Gauge trader sentiment through news and social media platforms to identify irrational behaviors.

- Technical Indicators: Utilize indicators like the Relative Strength Index (RSI) to detect overbought or oversold conditions that may hint at potential reversals.

- Risk Management: Implement strict risk management rules to protect your capital—setting stop-loss orders is vital.

By integrating these strategies into your trading routine, you can navigate the complexities of CS2 Reverse Trading and position yourself for long-term success.

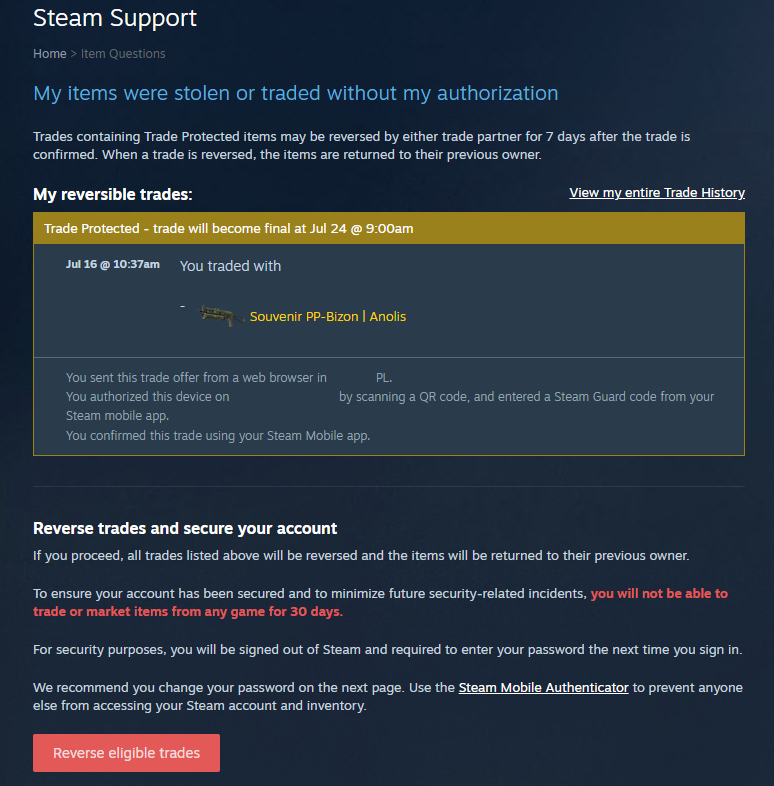

Counter-Strike is a highly popular first-person shooter that has captivated players worldwide since its inception. The game emphasizes teamwork, strategy, and skill, allowing players to engage in intense battles. If you're interested in learning how to reverse trade cs2, there are numerous resources and guides available to help you navigate the trading system effectively.

Is Reverse Trading the Hidden Gem of CS2 Profit Strategies?

In the ever-evolving landscape of CS2, players and investors alike are constantly on the lookout for profitable strategies. One method that has surfaced as a **strong contender** is reverse trading. Unlike conventional trading techniques that follow the market's upward trends, reverse trading involves making strategic purchases when the market is poised for a downturn. This counterintuitive approach can prove highly lucrative when executed with precision, especially for those who take the time to analyze market data and player behavior. Understanding the nuances of reverse trading could very well make it the **hidden gem** in your CS2 profit strategy arsenal.

To successfully implement reverse trading, there are several key factors to consider:

- Market Analysis: Keep a close eye on market fluctuations and trends to identify potential downturns.

- Timing: Knowing when to enter and exit trades is crucial; waiting for the right moment could lead to significant gains.

- Risk Management: As with any trading strategy, assessing your risk tolerance and managing your investments wisely is essential for long-term success.

Top Mistakes to Avoid in CS2 Reverse Trading

When engaging in CS2 reverse trading, one of the top mistakes to avoid is not conducting thorough research on the market trends. It's essential to understand the dynamics of reverse trading, including which items are in demand and how their values fluctuate. Ignoring this can lead to uninformed decisions that may result in significant losses. Be sure to analyze price histories and community discussions before making trades, as this can provide valuable insights into the best trading strategies.

Another critical mistake is failing to set clear limits on your trades. Without defined parameters, traders often succumb to emotional decisions, leading to overtrading or holding onto items for too long in hopes of a better price. To navigate the complexities of CS2 reverse trading, establish both entry and exit points before initiating any trade. This disciplined approach will help in minimizing losses and maximizing profits in the long run.