Insights Hub

Your go-to source for the latest news and information.

Save Big with These Surprising Auto Insurance Discounts

Unlock hidden savings! Discover surprising auto insurance discounts that can save you big bucks. Don’t miss out—click now!

Unlock Hidden Savings: Top Auto Insurance Discounts You Didn't Know Existed

When it comes to auto insurance, many drivers are unaware of the variety of discounts that can significantly lower their premiums. Some of the most common yet often overlooked savings include the good student discount, which rewards young drivers who maintain a high GPA, and the multi-policy discount, available to those who bundle their auto and home insurance. Additionally, some insurers offer a safe driver discount for individuals who have a clean driving record without any accidents or violations. Taking the time to ask your insurance provider about these options could unlock hidden savings.

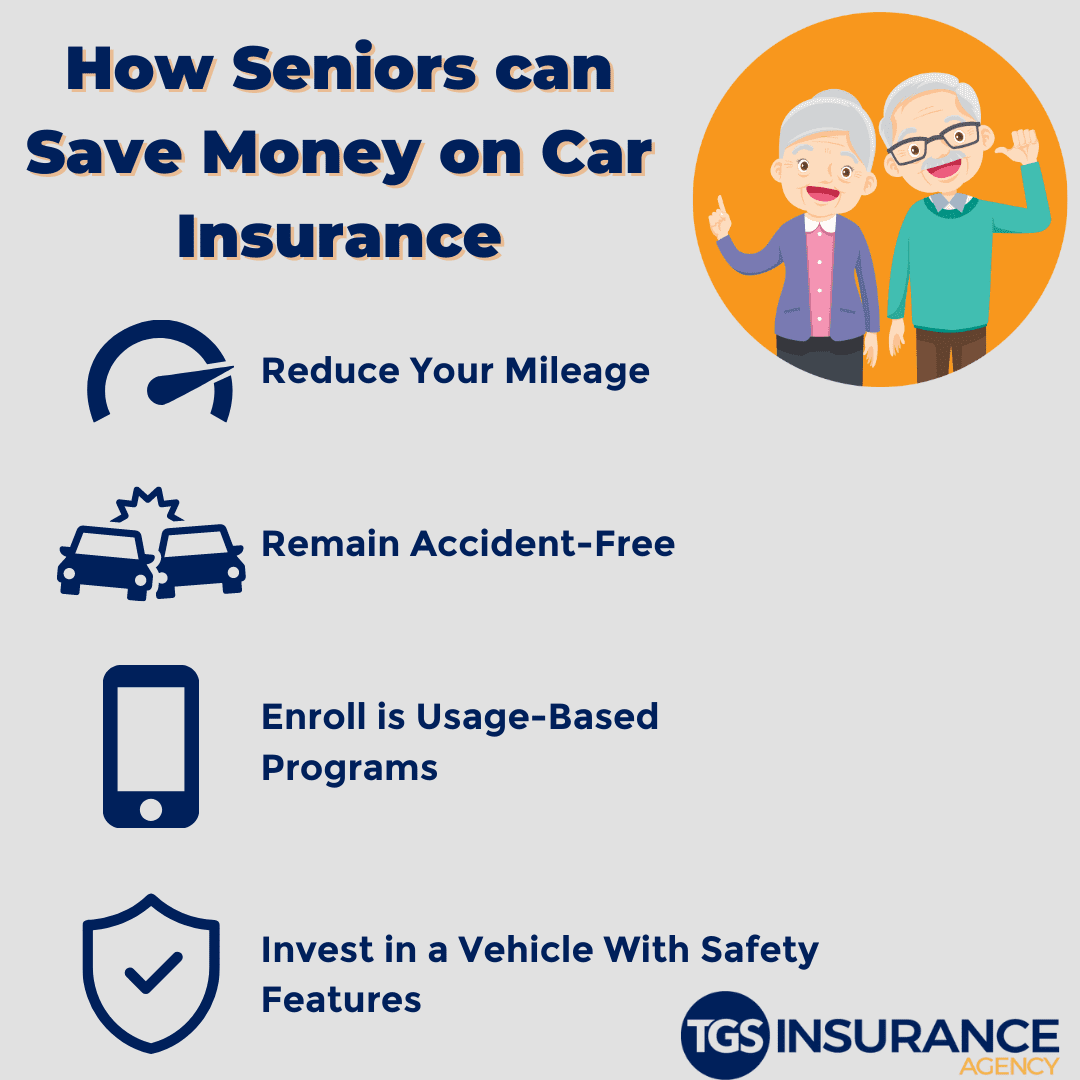

Another avenue for discovering hidden savings in auto insurance lies in utilizing technology. Many companies now provide usage-based insurance programs, where your driving habits are monitored via a mobile app or device, offering potential discounts for safe driving behaviors. Furthermore, participating in defensive driving courses can also fetch you discounted rates, as insurance companies view these courses as a way to promote safer driving. Remember, it’s always wise to discuss all possible discounts available with your insurer to ensure you are getting the best value for your policy.

Are You Missing Out? Common Misconceptions About Auto Insurance Discounts

Many drivers are unaware of the numerous auto insurance discounts available to them, leading to higher premiums than necessary. One common misconception is that only specific demographics, such as students or senior citizens, qualify for these discounts. In reality, insurers offer a wide range of incentives based on various factors. For instance, safe driving records, bundling policies, and even technology usage, like installing anti-theft devices, can significantly reduce your insurance costs. Therefore, it’s essential to explore all available options and ask your provider about potential discounts that apply to your situation.

Another prevalent myth is that all auto insurance discounts are automatic and require no effort to obtain. While some discounts are indeed applied automatically, many require drivers to be proactive. For example, to qualify for a multi-vehicle discount, you may need to inform the insurer of all vehicles under your policy. Furthermore, certain organizations, such as employers or professional associations, may have special agreements with insurance companies that offer unique discounts. Therefore, it's crucial to review your policy regularly and communicate with your insurer to ensure you are not missing out on valuable savings.

How to Qualify for Crazy Auto Insurance Discounts: A Complete Guide

Understanding how to qualify for crazy auto insurance discounts can significantly reduce your overall premiums. Insurance companies often provide various discounts based on factors such as your driving history, the type of vehicle you own, and even your demographics. To get started, consider these options:

- Safe Driving Record: Maintaining a clean driving record free of accidents and violations can yield substantial savings.

- Multiple Policies: Bundling your auto insurance with other types, such as home or renters' insurance, may unlock additional discounts.

- Defensive Driving Courses: Completing an approved defensive driving course can demonstrate your commitment to safety, often resulting in lower rates.

Additionally, many insurance providers reward loyalty and engagement. If you've been with the same insurer for several years, inquire about loyalty discounts. Furthermore, participating in usage-based insurance programs, where your driving behavior is monitored, can lead to discounts for safe driving habits. Remember to consult your insurance agent regularly about any crazy auto insurance discounts you might be eligible for, as companies frequently update their policies. Ensuring that you are aware of all possible discounts will help you make informed decisions and maximize your savings.